Whether you are thinking of moving home, an Estate Agent yourself, or an investor in the industry, continue on for an in-depth review of the UK property market, exploring who 'won' in 2020 and what picture this paints for 2021.

Key Headlines:

- Independent Estate Agencies were the biggest winners in 2020 with very strong growth in New Instructions and Sales Agreed volumes and looks set to continue into 2021.

- Hybrid agents had static New Instructions growth in 2020 and actually sold less property than in 2019, and looks set to stagnate throughout 2021.

- Large Agents and Corporates lost ground in 2020, but the Corporates in particular bounced back from June 2020 and ended the year with a large increase in market share.

- Franchise operators had mixed fortunes in 2020, instructing less but selling more. This is deemed unsustainable in 2021, consequently seeing drops in New Instructions and Sales Agreed market share.

Growth in New Instructions in 2020

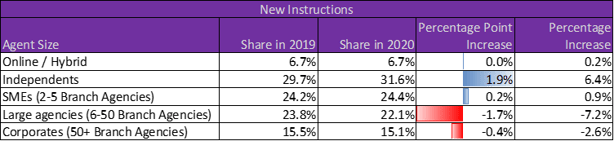

The above table shows the share of the market of each of our segments for 2019 and 2020.

The blue and red lines show the percentage point increase in the volume of new instructions and suggest the following key take-outs:

- Hybrid agents' market share as a collective barely moved in 2020 in comparison to the previous year.

- The Independent Agents' experienced a 1.9% percentage point increase with their share of the market increasing to 31.6%.

- The biggest losers were the large agencies, and we suspect that many of these agents furloughed staff as they closed branches in Lockdown 1.0 and did not react soon enough to bring back their staff to take advantage of the subsequent increases in activity brought about by the pent-up demand and further fuelled by the stamp duty holiday.

- Interestingly enough, corporate agents very quickly reacted to the government furlough scheme and came back very strong in June and with a late rally, ended the year with a 17% share in December 2020.

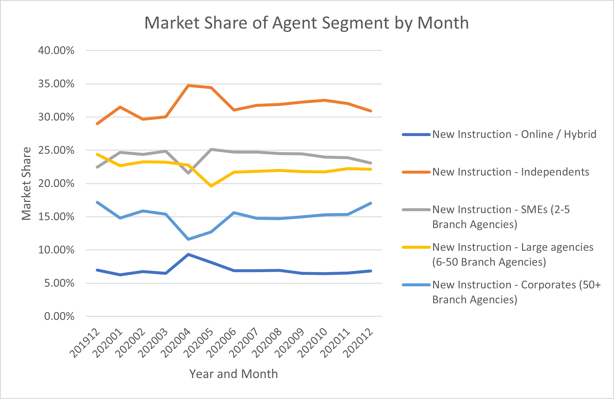

The table above only tells part of the story. To understand in more detail the breakdown of market share by segment, the following graph highlights that both Independent and Hybrid Agents did gain market share in Lockdown 1.0. Although this fell away quickly in the case of the Hybrid Agents.

Growth in Sales Agreed in 2020

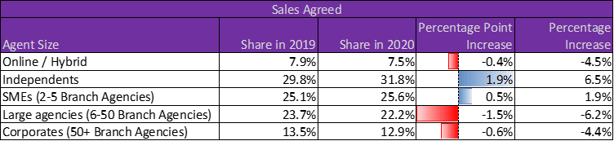

Most agents however get paid commission when a property sale completes and therefore tracking the winning of New Instructions as we have done above, whilst interesting, does not follow the money.

The following table presents the position of the segments in 2020 for Sales Agreed volumes.

While it broadly follows a similar pattern to the New Instruction volumes table further up, Hybrid Agents have actually lost market share in Sales Agreed by a -0.4% percentage point decrease. To put that in numbers, we are talking about nearly 5,000 properties less having a sale agreed in 2020 versus 2019.

Franchise Operations in 2020 in Sales Agreed in 2020

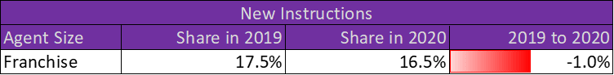

Franchise operations have had a somewhat curious year, where their market share of New Instructions had dropped by 1 percentage point to 16.5%.

Putting this into perspective, this represents 6,700 New Instructions less in 2020 than in 2019.

But, its not all doom and gloom, as when it came to agreeing sales, the Franchise operators' market share rose by 0.4 percentage points.

Franchise operations collectively sold about 1,800 more properties in 2020 than the previous year, but from 6,700 less instructions. Clearly this would prove costly in the long term as it is not sustainable.

Painting the Picture for 2021

Clearly it is very early days in terms of data that we have seen so far this year, but it is obvious some of the key trends experienced in 2020 are continuing in 2021.

Here are a few to take away with you:

- Hybrids are remaining static

- Independents are growing rapidly

- SMEs and Large Agents are declining in market share terms

- Corporates are continuing to grow as they did through 2020 post Lockdown 1.0

- Franchise market share is reducing now both in New Instructions and Sales Agreed

Our Thoughts

It will be intriguing to see how early on these 2021 trends continue throughout the duration of the year especially with the announced mergers and acquisition activity in the corporate and franchise segments.

You can count us on to be keeping a close eye on how these trends develop as always.

However, what is happening with the branches themselves by segment is a topic we will be unravelling this time next week.

If you would like to know more about what's happening in the property market or about how we can help your brand to obtain greater returns from targeted marketing then please contact Katy Billany, (Our Executive Director for Estate Agency Services) at katy.billany@twentyea.co.uk.