There’s a huge shift happening in the type of property we want to live in here in the UK. We’ve analysed the supply and demand of houses and flats in the UK property market over the past 5 years and found some shocking changes so far in 2021. The demand for flats is worryingly low when compared to the current boom in demand for houses. Let's take a look into the supply and demand figures to illustrate the current situation.

Houses vs Flats: Supply and Demand in the UK (Residential Sales)

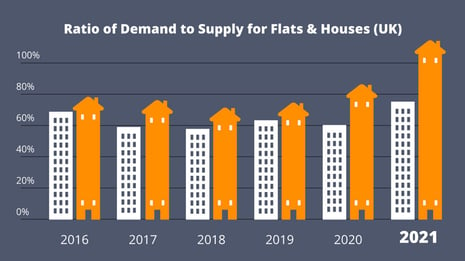

We’ll start by looking at the supply vs demand of flats and houses in the UK over the past 5 years.

Flats: Supply vs Demand for Residential Sales 2016-2021

- From 2017 - 2020 the demand for flats was around 60% of supply.

- This means for every 100 flats listed for sale, around 60 will receive a sale agreed.

- In 2021 the percentage has shifted to around 80%.

In isolation, this paints a very positive picture. Yet, this picture is misleading.

Houses: Supply vs Demand for Residential Sales 2016-2021

Comparing this to the performance of houses in the current market, it becomes clear that flats are performing poorly.

- From 2017-2019 roughly 75% of houses on the market had a sale agreed.

- In 2020 this increased to 86%.

- In 2021 so far the demand is at 115%.

The property market is booming, but houses are by far the preferred option for buyers. There aren’t enough houses on the market to fulfil demand and it’s a sellers market across the UK as a whole.

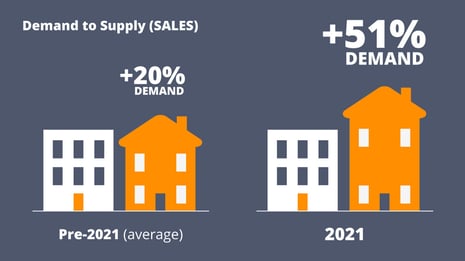

Residential Sales 2021: Demand for Houses Soars at 51% More Than Flats

Prior to 2021, the demand to supply ratio of houses to flats was 20% more, but this year demand for houses is soaring at 51% more than flats.

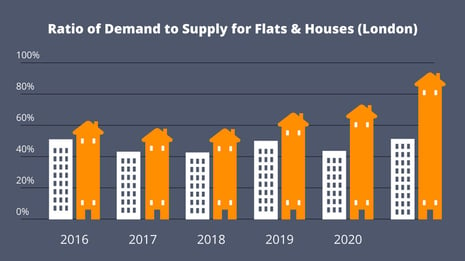

Houses vs Flats: Supply & Demand in London (Residential Sales)

At present, the market dynamics in London are the polar opposite to the rest of the UK. So far in 2021 London is a buyer’s market. So, what does the supply and demand for houses and flats look like in London specifically?

The London Flat Market is Suffering

Whilst the demand to supply ratio of houses to flats has soared to 51% across the UK, in London it has reached 81%.

In London, the disparity between house and flat sales is even greater than the rest of the UK. This has a big impact on the stability of the London flat market, and it’s clear that something needs to be done to restore confidence in the safety of flats.

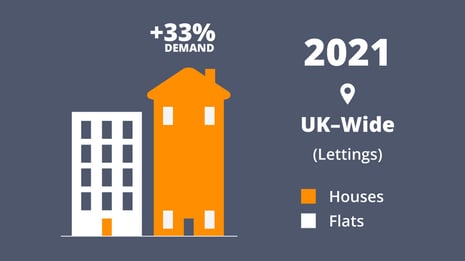

Houses vs Flats: Supply and Demand in the UK (Residential Lettings)

Let’s assess the lettings market to see if the supply and demand of houses and flats follows a similar pattern.

Prior to 2021, there was on average around a 13% ratio of houses outperforming flats on demand to supply.

In 2021 the ratio of demand to supply for houses outperformed flats nationally by 33%.

In lettings as well as sales, houses are in much greater demand. As flats are an integral part of urban living, it’s crucial that resolutions are found to restore confidence and invigorate demand for flats.

Why is this Happening?

There are a range of issues affecting the demand for flats in 2021, but there are two drivers that have been instrumental in the recent downturn.

The Grenfell Tower Fire

Ever since the terrible tragedy of the Grenfell tower fire in 2017, in which we must not forget that 72 people lost their lives, there has been concern around the safety of flats. So, what has been done to address this and how is it affecting the popularity of flats for residential sales and lettings?

- Advice Note 14: Government guidelines introduced in December 2018 meant that the only way to know if a building is safe is to look at a fire safety report conducted after the guidelines were introduced. In some cases, it can require an intrusive inspection to satisfy the regulations which takes time, money and resources.

- ESW1: To restore confidence in the high-rise residential buildings market, the Royal Institute of Chartered Surveyors developed the EWS1 form which came into use in December 2019. Basically, this meant that any high-rise flat which hadn’t had its cladding recently checked and confirmed as completely safe via an EWS1 (external wall safety certificate), was essentially worthless. Without the certificate, mortgage providers have been refusing to lend to anyone who wants to buy potentially dangerous properties and the current owners are unable to sell. To compound the problem, there are currently nowhere near enough EWS1 assessors to perform the required surveys in a timely fashion.

- An end to unsafe cladding: In the middle of last month, the Government announced that they would pay for residential leaseholders to make their properties safe in buildings higher than 18 meters. But where does that leave properties less than 18 meters in height?

Essentially, safety is paramount and the latest measures so far fall short when it comes to improving the buoyancy of the market for flats.

Prolonged COVID-19 Lockdown Measures

The unique circumstances that COVID-19 lockdown measures have brought about have seen the UK public spend more time confined to their dwellings than ever before. The following factors are also contributing to the lack of demand for flats:

- Lack of outdoor space: with trips outdoors kept to a minimum, home buyers are increasingly looking for property with a garden.

- Shared areas: concerns around sharing living areas with others are likely to play a role in the reduced demand for flats.

- Crowding/noise: recent sales trends show the popularity of detached houses increasing as buyers try to find space for themselves and their family.

- Personal space: buyers are looking for more rooms to help them create personal space for family members and room for hobbies or home working.

- Working from home: remote working has reduced the need to dwell in inner city locations for many, leaving them able to relocate to more rural areas.

The above factors are illustrated in our investigation of lockdown impact on the property market.

The Future of Flats in 2021 and Beyond

There are some serious issues that are having a major impact on the stability of the flat market. This issue is particularly prominent in London. We hope the Government’s announcement last month coupled with the roadmap for easing lockdown begins to address the issues, and we will continue to monitor the situation over the coming months.