Average house prices for first time buyers have risen by 3.5% a year over the last five years.

With prices increasing at these rates, we wanted to take a look at what this means for first time buyers. What does it take to get on to the property ladder in 2021, and is property still as safe an investment as ever?

First, we’ll consider the journey of the average property owner so we can see which property types the house price increases are having the most impact on.

Property Types: The Average Homeowner Journey

The average homeowner moves every 19 years and therefore, buys 3 - 4 properties in their lifetime. The property journey tends to cover the following types:

- First time buyer

- Second stepper

- Family home

- Executive home

So, what is happening with the buying prices of these property types over time, and how does this affect the affordability for first time buyers in the UK?

Property Prices in 2021: Can First Time Buyers Afford it?

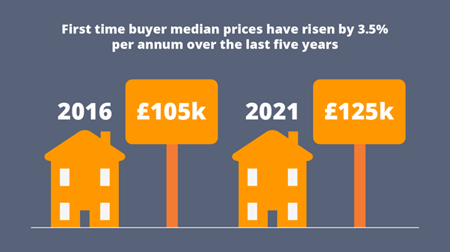

Today, a typical first time buyer property will be advertised for £125,000. The average ‘first time buyer’ house price has risen 19% over the past five years.

Although this might sound a lot, asking prices have only grown by 3.5% per year.

For second steppers and family homes, growth in asking prices has been similar. Second steppers have increased 4% per year and family homes 3.1% per year.

The exception is the executive home, which has increased annually at 1.3%.

So, first time buyer property prices have been increasing, but not escalating at a rate that’s out of the ordinary. Is this the case across the whole of the UK?

Property Prices in 2021: Regional Prices

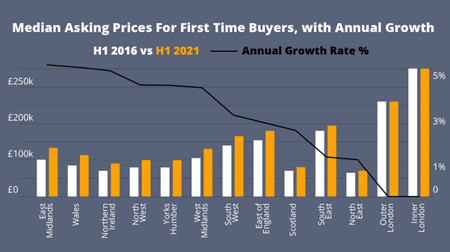

We’ve also compared the median asking prices per region for the first half of 2021 with the first half of 2016. The chart below is sorted by property price growth.

Our analysis confirmed that it is significantly more expensive for a first time buyer to buy in London than in the rest of the country. This is no surprise as house prices are highest here. What is interesting is that house prices haven’t grown in either inner or outer London over the past 5 years.

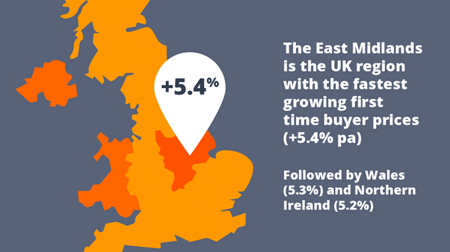

The largest property price growth has been seen in the East Midlands. In this region, the median first time buyer house price has risen from £100,000 to £130,000 in the past 5 years. This is the equivalent of 5.4% per year. Although the East Midlands is the highest growth region it is quickly followed by Wales (5.3%) and Northern Ireland (5.2%)

The more expensive areas in the South (outside of London) have not seen as much growth in house prices. In the South East, asking prices increased by 1.6% on average each year for the last five years.

We can clearly see a discrepancy between regions but property prices are also relative, so this isn't the end of the story. Our next step was to compare the average regional first time buyer house price with income data relative to that region.

Property Prices in 2021 Compared with Incomes

Now we have determined the average property prices, we can see how this compares with income to determine affordability.

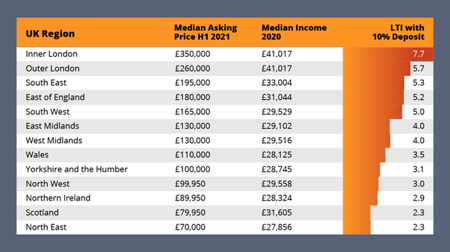

The table below looks at the average house price for a first time buyer. We compared this with median incomes from 2020, sourced from Statistica. Using an average deposit rate of 10%, we have calculated the loan to income values.

Loan to income values vary considerably across the UK. We can also see a clear North/South divide in terms of affordability.

The FCA (Financial Conduct Authority) limits the amount of mortgages issued at more than 4.5 times individual incomes. With this in mind, homes in the South are simply not affordable for first time buyers even if they are earning the median income. More financial support is needed to access the deposit funds required, such as parental support. The government has recently issued yet more assistance which is now filtering through the lenders. Clearly, this is needed.

Despite the house price rises over the past 5 years in these regions, the Midlands and the North remain much more affordable for first time buyers. Buying property in these areas is better aligned with income levels.

Is First Time Buyer Property Investment "as Safe as Houses"?

In relative terms, our data shows that it is getting more expensive to take the first step on to the property ladder. However, we can also clearly see that property investment is indeed still ‘as safe as houses’.

Around two thirds of residential property in the UK is owner occupied, so we need to look after the needs of our first time buyers to maintain this level of home ownership. On average, median incomes have risen in the last five years by 2.2% per annum whilst median asking price growth is around 3.5% per annum. For first time buyers the regional disparities could result in your income rising by 2.2% and the pricing of property rising by 5.4% (if you live for example in the East Midlands).

The growth rates over the past 5 years make property a very sound investment. There’s no doubt that it’s getting harder for first time buyers to take the leap into property ownership, and this may be a deterrent for some. But there are many benefits to property ownership including the investment opportunities. Where buying is a possibility, despite the financial challenges that getting there may present, it will still pay off in the long run. The long term gains are well worth the short term sacrifices for first time buyers.

For more information, or to learn more about our property market insights, then please contact Katy Billany, (Our Executive Director for Estate Agency Services) at katy.billany@twentyea.co.uk.