On average, homebuyers pay 25% more for new build properties.

Of course, new builds offer homebuyers plenty of benefits. They won’t need any redecoration or costly renovation, but how much is this peace of mind actually worth?

25% is quite a premium to pay for buying new. Across the UK, the average house price is £316k for a new build vs £253k for an existing property. That’s a value of around £63k more for a brand new home. Such an amount could go a long way to redecorating or renovating a resale home.

The Benefits of Buying a New Build Home

When you weigh up the pros and cons, there are actually a whole host of benefits to buying new. An expert round-up by the HomeOwners Alliance covers these in full, showing that a new build home can give you benefits such as:

- Modern living and latest home technology

- A home warranty

- Design input

- Low bills

- Chain free buying

- Incentive schemes

- Lower initial maintenance costs

The pros do stack up but there are cons, too. Equally, buying an existing property comes with it’s own advantages and disadvantages.

Older properties tend to offer more space, character and community. Many older properties provide a lot of potential, and a little work can lead to a significant increase in value. So, it’s very interesting to observe what we are willing to pay for the benefits of buying a new build home.

New Build Price Premiums by Region

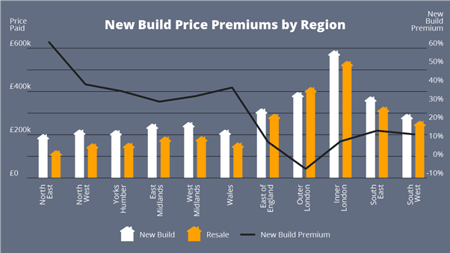

We carried out an analysis on the new build price premium across the different regions of the UK. The percentage premium varies considerably by region:

The highest percentage premium for new builds was found in the North East. Let’s examine the average prices for a new build vs existing property:

- New Build: £201,950*

- Existing Property: £125,000*

- Buyers are paying almost 65% more for new build properties

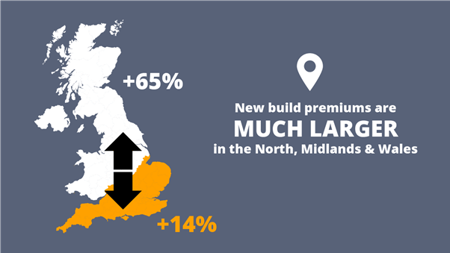

The chart above also illustrates that new build premiums are much higher in the North, Midlands and Wales than the South of England.

In the South, new build premiums are around 14%. The new build premium is relatively low in London, and Outer London is the only place that does not have a premium price for new property. Buyers here would pay less for a new build than an existing property, on average.

Why Do We Pay This Premium?

There are many reasons why we are willing to spend a little more for a new build property. A poll by Yopa discovered that moving house was rated the most stressful life event, and 60% of people have put off a move due to the stress it brings about.

Moving to a new build can make the process a little less stressful: we feel safer in the knowledge that everything is prepared for us. The latest standards need to be upheld and we’re not waiting for anyone to move out. A property chain can be a great source of stress, and knowing there is nobody above us in a chain can make things feel easier and more secure.

Luckily, there are tools like View My Chain and Chain Unlocker to give both buyers and Estate Agents the information they need to manage the property chain and accelerate sales progression. Where buyers are willing to navigate the slightly more complex process of buying an existing property, there’s a high chance this will pay off.

If we consider this in terms of immediate and long-term benefits: a new build might alleviate short-term stress but an existing property has the potential to offer a bigger payback further down the line. Perhaps many of us are willing to pay more to make our lives easier in the here and now.

Further to these factors, large home development companies have a wealth of knowledge when it comes to home staging and the psychology of home buying. Chances are, they can tap into buyers impulses with stunning show homes and by creating a development with a set of benefits to sell. This isn’t so easy for an independent seller to do, and when it’s coupled with buying incentives and other factors used to make the buying process simple, it’s easier to demand a premium.

What Can we Learn from the New Build Price Premium Analysis?

In England and Wales as a whole, home buyers are willing to pay 25% more for a new property. This means buying a resale property can save a buyer around 63k on average.

As we touched on earlier, this is a significant amount towards home improvements or renovations. Based on this analysis, it’s likely that homebuyers purchasing an existing property are more likely to have the spare cash to improve their home than new build buyers. They may have even factored improvements like a kitchen or bathroom remodel, update to electricals or new furniture purchases into their budget.

Home improvement brands can make good use of this information by marketing to the right people at the right stage in the buying process. Homebuyers can consider this information as part of their buying process, as many may not even be aware of the premium they are paying for a new property.

There’s no denying that new properties offer some attractive benefits, and as we can see, many homebuyers are happy to pay a premium for these.

*average property values refer to the median values for this region.

For more information, or to learn more about our property market insights, then please contact Katy Billany, (Our Executive Director for Estate Agency Services) at katy.billany@twentyea.co.uk.