80% of the UK’s millionaires made their money through property. That’s quite a statistic!

As property prices rise in the UK, properties with a value of 1 million or over are increasingly owned by more ‘ordinary’ people. We take a deeper look into the UK’s 1 million pound properties and find out more about their place in the property market today.

Million Pound Property Locations

Our valuation estimates suggest there are over 770,000 UK properties valued at £1 million or more. This is approximately 2.5% of all UK residential property.

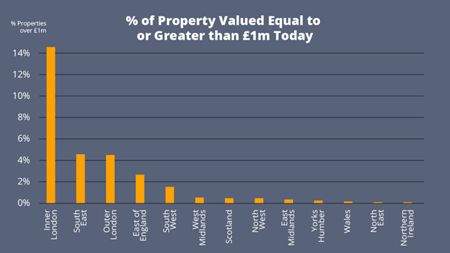

We took a look at where these properties are in the UK, comparing the percentage of properties valued over £1 million in each region.

It is not surprising that Inner London completely dominates the chart. 14.6% of all properties in this region are valued at over £1 million.

In fact, 52% of all UK residential properties valued at greater than £1million are in London. A massive 43% of these are in Inner London.

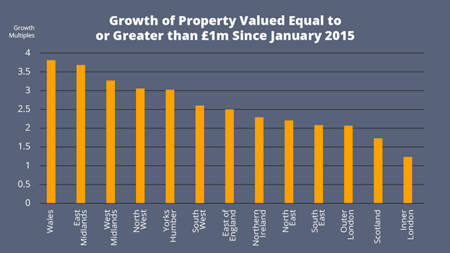

What this doesn’t show us is where there is growth in properties valued at £1 million or more.

As you can see, the largest growth area is Wales. There are now 3.8 times as many £1 million properties in Wales as there were in January 2015. That’s quite astonishing growth!

The Midlands and the North aren’t far behind in terms of growth, but they did start from a fairly low base.

Million Pound Property Transactions

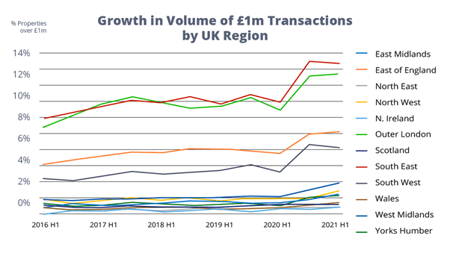

We have observed over 110,000 million pound property transactions since the beginning of 2016. These are growing the fastest in the East Midlands. In this region, the compound annual growth rate of £1 million plus transactions has grown by 32% per annum, on average. In comparison, growth in inner London for the same period was just 6%.

If we take Inner London out of the picture, it’s easier to focus on the growth in the other regions.

This chart clearly illustrates the majority of the growth has occurred in the last 18 months - during the stamp duty holiday. Such significant savings made a £1 million plus property purchase more achievable and quite possibly, more lucrative in the long term too.

This chart clearly illustrates the majority of the growth has occurred in the last 18 months - during the stamp duty holiday. Such significant savings made a £1 million plus property purchase more achievable and quite possibly, more lucrative in the long term too.

Regionally, the South East tops the list in terms of growth in £1 million property transactions. Here, 4.7% of property transactions were conducted on £1 million plus properties. This rose from 3.5% in the first half of 2020.

Why are People Selling More Million Pound Properties?

After recent price rises and pandemic-related constraints, are people cashing in on their equity and downsizing? Or are people selling their £1 million plus properties to upsize?

We joined forces with our sister company View My Chain to look into the chain data in more detail.

Our findings were quite surprising!

- Over 50% of the £1 million property purchases were upsizing to the greater than £1 million price band

- 33% of transactions were downsizers

- 17% moved across from one £1 million plus property to another

The UK’s £1 Million Properties: In Summary

The past two years have been quite extraordinary for the property industry. This has brought about an increase in the number of £1 million plus properties available and in the volume of £1 million plus properties being sold.

But how sustainable are these changes? Even with a 10% deposit, the purchase of a £1million property would require an annual salary in excess of £200,000. Now the vast majority of stamp duty savings have disappeared, will this growth begin to slow?

Will the prices of homes at the top end keep going up? Or will more people buy these homes and split them into more affordable flats and apartments? As usual, we will be monitoring this with interest.

For more information, or to learn more about our property market insights, then please contact Katy Billany, (Our Executive Director for Estate Agency Services) at katy.billany@twentyea.co.uk.