As we continue to explore the data for rental properties, let’s look at the big picture for investments. Across the UK, cities show vast differences in sale and rental prices. You could guess that properties are cheaper or more expensive from one city to the next. However, what’s not instantly clear is the rental yield a Landlord could obtain in each city and how this compares to what they would have received from investment in stocks and shares. So how do landlords know how and where to invest?

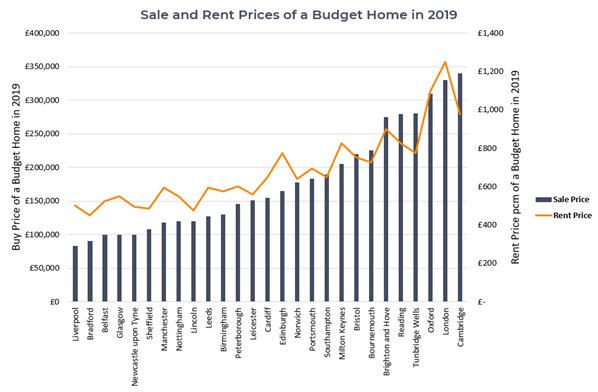

When going through the Budget Homes (1) category within our data, the cheapest city in the UK to buy a budget home is Liverpool at £83,000 and the most expensive city is Cambridge at £340,000.

What about the rest of the UK?

Broadly, we can see that as property prices rise, so do rental prices.

However, there are some key insights we can take from the above chart:

- Cheaper places to buy housing have disproportionately higher rents:

For example, the rental price of a budget home in Liverpool is not that much different to Belfast, Newcastle, Sheffield or Nottingham. But the price of property is cheaper. Landlords are therefore better off buying in cheaper areas because rental yields are higher. - The largest cities attract higher rental prices:

Glasgow, Manchester, Leeds and Edinburgh have seen attractive peaks in rental prices. - The top 3 expensive cities to rent a budget home are close in price:

Whilst London is clearly the most expensive place to rent a budget home at £1,250pcm, Oxford (£1,100 pcm) and Cambridge (£975pcm) are not that far behind. - Low rental price compared to property price could mean a rise in rental yield:

Brighton and Hove, Bournemouth, Reading, Cambridge and Tunbridge Wells appear to have low rental prices when compared to their property prices. This should indicate a future rise in rental yields (rental prices to catch-up). However, rental yields are falling year on year in all these cities aside from Cambridge.

So, if you had £250,000 to invest in buy-to-let property, where should you invest it?

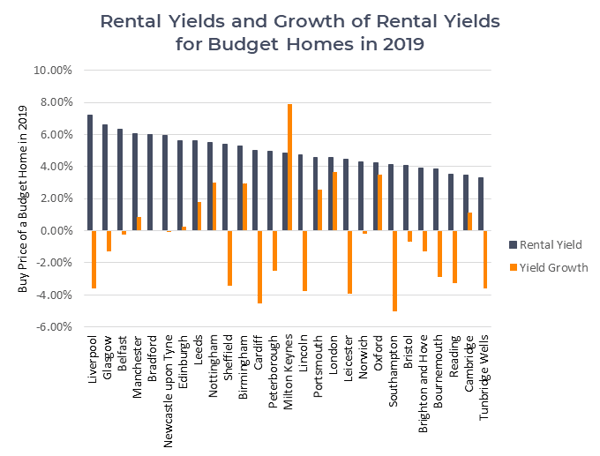

Two factors are important to consider:

- Which areas currently have high rental yields?

- Are rental yields growing year on year?

What’s happening across UK cities?

According to our data, here are some cities worth looking into for investments:

- Manchester, Edinburgh, Leeds, Nottingham and Birmingham, all have comparatively high yields and are experiencing year on year growth.

- Milton Keynes looks very interesting because of the exceptionally high growth in rental yields compared to all the other cities on the list.

- London, Oxford, and Cambridge, although comparatively expensive to invest, remain the “safe bets” because rental yields are rising in all three

Which cities are facing a long-term decline? Find out in our next blog post.

1 - Typical Budget Home value has been defined as the value of a home in the 25th percentile – i.e. where 25% of homes that were sold in 2019 are cheaper than this value and 75% of homes are greater than this value