The Growth/Share Edition

In 2021 so far we have seen unprecedented demand for property in the UK. A number of factors have combined to drive this demand. Pent up demand from the pandemic, a stamp duty holiday and strength of the sections of the economy that are able to buy property have all played a part.

- Property demand has grown in 2021 to-date at an average of 38%.

So, where is this demand coming from? We have analysed the growth and share of sales agreed using the BCG Growth Share matrix to assess regions, property types and prices.

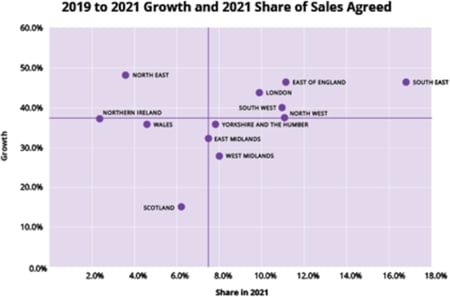

Regional Property Demand in 2021: 2019 - 2021 Growth and Share of Sales Agreed

In the top right quadrant we can see the best performing regions. The South of the UK has been the most impressive, with a higher than average growth and a larger share of the total market.

The South East has the highest share of the market of any region at nearly 17%. Sales agreed in this region are still growing in excess of 47%. This is a compound annual growth rate (CAGR) of over 21%.

It is worth noting that London's demand was initially sluggish because of the pandemic. But now, it has bounced back stronger in 2021.

The Midlands, Yorkshire and the North West experienced lower than average growth. However, their sales agreed growth is still good, and their share of the market is comparatively high.

The North East has a low market share but actually experienced the highest growth in demand of any UK region.

Scotland has the lowest growth in the UK, only 15%. This is due to the ending of the stamp duty holiday on the original timetable rather than extending it like the rest of the UK. In addition, Scotland's share of the market is low.

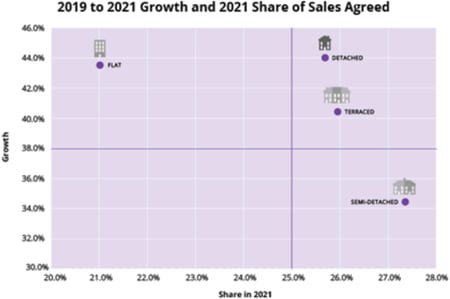

Demand by Property Type in 2021: 2019 - 2021 Growth and Share of Sales Agreed

Detached houses: Growth of demand for detached houses has been much greater in 2021 to-date than in 2019. This is a high market share and high growth property type.

Flats: Growth of demand for flats has also been much higher in 2021 to date compared with 2019, although their overall share is low.

Semi-detached houses: The largest share of the market, but not such a growth area so far this year. Their growth is 4% points off the average and 10% points off of detached properties.

It’s no surprise that those who can afford to are opting for detached houses post-lockdown. This type of property offers more personal space, peace and quiet. They are also the most likely property type to have a substantial garden, something many homeowners have desired in recent times.

Property Demand by House Price Bands: 2019 - 2021 Growth and Share of Sales Agreed

In 2021, the highest priced properties have seen the highest levels of demand growth.

Key Figures: The Highs

- Properties over £750k have a whopping 83% growth rate

- Despite this, they still only have 6% market share

- £250-£500k properties have the highest market share. These have also had above average and exceptional demand growth rates.

Key Figures: The Lows

- £0-150k properties have had much slower than average growth

- Growth rates for this price band have struggled at around 4%

As discussed in our March analysis of the property market, the stamp duty holiday is likely to have driven purchases in the higher price bands.

It will be interesting to see how far into 2021 this level of demand for property endures, especially when we consider the relative lack of supply.

However, our analysis shows that high-value properties are driving the demand. These buyers have not been affected by economic effects of the pandemic, so the underlying property market remains strong.

At this stage the economy is still fragile. With the threat of potential recession looming due to inflation and unemployment, there may yet be significant changes in the property market this year.

For more information, or to learn more about our property market insights, then please contact Katy Billany, (Our Executive Director for Estate Agency Services) at katy.billany@twentyea.co.uk.