We talked last week about the continued stock shortage at the end of last year. It’s fair to say that everyone has been hoping that the dawn of 2022 would see renewed interest from vendors and an increased volume of properties coming to the market. So, we’ve looked at activity across the UK in the first two weeks of the year to see what that shows us about buyer and seller sentiment compared to previous years.

Although this is only based on 14 days and so can’t be used as a true barometer as to what the coming months might look like, it seems that the stock issues may be set to continue, at least in the short-term.

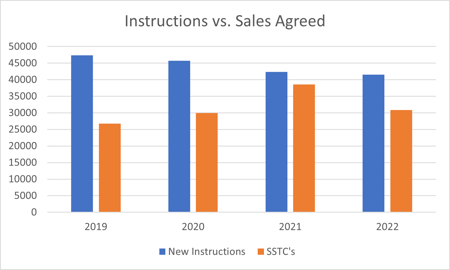

The Sales Market

The headline news is that we’ve not seen an immediate influx of new properties coming to the market in the New Year.

New Instruction volumes are down 2% on the same period last year, down 9% on 2020 and a massive 12% down on 2019.

In addition, it seems as though the unprecedented levels of demand that we saw throughout most of 2021 have not materialised so far this year. Sales agreed were 20% lower in the first two weeks of this year than at the start of 2021.

That being said, sales agreed were still 3% up on the start of 2020 and a huge 15% on 2019, so this could be seen as an encouraging sign for the industry. It may be the first indication that we are returning to a more normal market where traditionally demand (sales agreed) is around 75% of supply (new instructions).

However, this isn’t necessarily good news for agents if instruction levels remain lower than usual as it’s clearly preferable to have high demand for the properties that are coming to market, than to have both fewer instructions and fewer buyers.

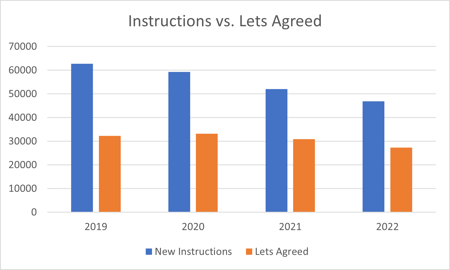

The Lettings Market

We’re seeing similar trends in lettings, in that both supply and demand has fallen compared to previous years. Often when sales activity stagnates, we see a more buoyant lettings market but that has not been the case so far this year.

Instruction volumes are down 10% on the previous year, 21% on 2020 and over 25% on 2019. Similarly, the number of Lets Agreed are down 12% on last year, 18% on 2020 and 15% on 2019.

The encouraging sign for the industry is that demand is falling less than supply, and whilst it is not as strong as it was, this is a good sign.

Whilst obviously this is a very short time frame and things can (and hopefully will!) change quite quickly, it’s interesting to see that 2022 hasn’t started with a surge of either supply or demand.

So what can agents do to increase stock levels?

Another interesting piece of analysis our analysts have completed this week is the most recent review of the performance of our ‘Forecast’ propensity to move model. This unique dataset accurately predicts properties that are likely to come to the market in the next 6 months and is something that our clients have found invaluable in helping them to deal with the ongoing stock crisis.

Forecast can not only help to win new instructions from properties not yet on the market, but is also a key tool in helping vendors to find their next property when there is nothing suitable For Sale. If you’re struggling to convert valuations to instructions as potential vendors can’t find anything on the market they want to move to, you can wow them by identifying and communicating with properties that are likely to list soon and which meet their exact criteria!

The great news is that in the last 6 months, Forecast successfully predicted 81% of the instructions that came to market and even better, in the last 3 months it predicted 86%!

So rather than spending money on blanket mailing campaigns, why not invest in a unique tool which means you’re the first to speak to the homeowners most likely to instruct in the near future?

If you’re interested in finding out more, get in touch!

--------------------------------------------------------------------------------------

For more information, or to learn more about our property market insights, then please contact Katy Billany, TwentyEA Executive Director at katy.billany@twentyea.co.uk.