Buying a property is a major life event, and most residential buyers and sellers have hopes, dreams, emotions and investment tied up in their decisions. Having a sale fall through can be devastating, both financially and emotionally. In 2021, the rate of sales falling through is on the rise. This is resulting in unrecoverable losses for affected buyers. We’ve analysed the UK property market data to determine the statistics for this year so far.

How Many Property Sales Have Fallen Through in 2021?

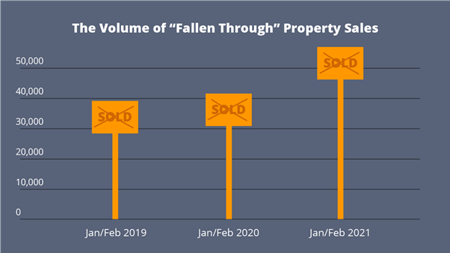

As of 28th Feb 2021, we tracked over 56,500 fallen through property transactions. This is a sharp rise compared to the same time period over the previous two years.

Fallen through property transactions in the first two months of 2021 were:

- 37% higher than the same period in 2020

- 46% higher than the same period in 2019

These results are concerning but should be considered in context. The volumes of property transactions this year are also much higher than they have been over the past 5 years, so more total fallen through transactions were expected.

What Percentage of Property Transactions are Falling Through?

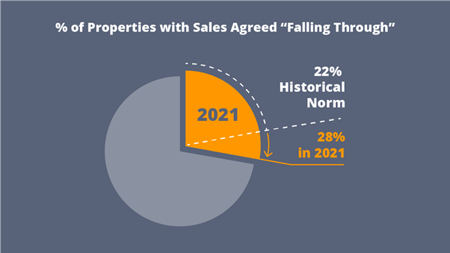

To analyse the state of this problem, we need to consider property transactions falling through as a percentage of total property transactions. For this, we have to project the results based on data we have access to so far, because recently agreed sales have not yet had sufficient time to proceed to completion or fall through.

Our projections suggest that the percentage of agreed property sales falling through in 2021 has risen from a norm of 22% to 28%.

This data has been calculated using the average progression times to estimate the fall through percentage.

So, it’s not just the overall count of property sales falling through that has increased. As a percentage of agreed sales, the fall through rate is rising. This is a problem for potential buyers and the industry as a whole.

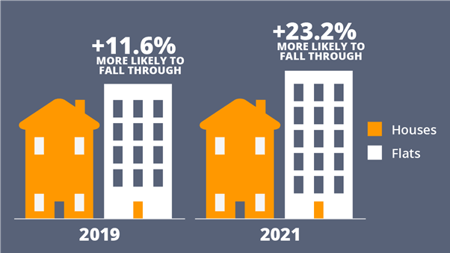

Flats are More Likely to Fall Through than Houses

We recently assessed supply and demand for houses vs flats in 2021, and it seems the problems with flat ownership don’t end there. Even when a flat sale is agreed upon, it is 23.2% more likely to fall through than a house sale in 2021. This is in comparison to 11.6% in 2019.

The Property Purchase Timescale has Lengthened

In recent years, the average timeline for a property purchase has been 12-14 weeks. Since late 2020, this has increased to an average of 22 weeks. Factors impacting on this include:

- Delays due to the pandemic

- Increased demand

- The current stamp duty holiday

As the timescale for property completion increases, there are more factors in a property transaction chain that can impact the likelihood of a sale to complete or fall through. But there are ways to manage and speed up the window from SSTC through to completion.

View My Chain, our sister company is a data-driven chain management tool that provides the best solution to help agents achieve lower fall throughs, faster completions and less wastage. Such a tool can help estate agents to support their buyers and protect their purchase, avoiding property fall through where possible. Until these lengthy property purchase timescales reduce, we’re likely to see high rates of property sales falling through.

In England and Wales, buyers are given the opportunity to fully investigate the property they intend to buy before committing to the purchase. It isn’t until the exchange of contracts that a commitment is made. This is typically 1-2 weeks before completion. That leaves 20 weeks for circumstances to change that could result in a property sale falling through. The process of progressing a transaction from an agreed sale to completion needs to increase dramatically to help slow the rise in property sales falling through in 2021 and beyond.